STOPS: a Deeper Look

In previous post I described a general approach to stops placement and trailing, and I also touched on the subject of contrarian trading. Let’s expand on this matter.

Obviously, if a method of a stop placement becomes commonly known and broadly used, sooner or later you will run into situations where the method “stops working”. In practice it means that the way you place your stops starts producing a higher percentage of cases where your stop gets hit just before the trade reverses and returns into a profitable zone. This phenomenon reflects the very nature of the market – it works in a way that allows the minority of players to take the majority’s money. According to this concept, every strategy goes through certain life cycles. At first it’s used by minority and produces a high percentage of success. As it becomes widely known, this percentage reverses and the strategy starts losing money. As the majority gets frustrated and abandons the strategy, it “starts working” again. You can read more on this in The Master Profit Plan .

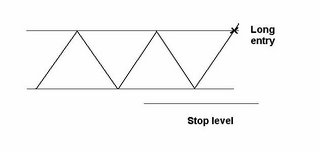

So, how can we utilize this understanding? There are two approaches to this matter. The first is defensive: Change your strategy in a way that puts you outside of the zone targeted by Smart Money. In practice it means that you need to analyze the charts of failed trades to find out more optimal level for your stops. Let’s illustrate this. Fig 1 shows a generally accepted approach to stop placement for a simple case of range breakout.

Fig 1. Original strategy

This method works successfully while trades executed in this manner work as shown in Fig 2: they reverse before hitting a stop (line 1) or, if a stop is hit, they proceed lower (line 2).

Fig 2. Original strategy works.

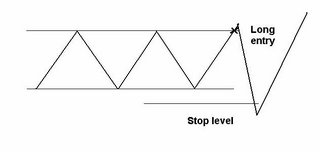

However, if you run into an increased number of situations, where your stop level is hit just before the trade reverses and returns into the profit zone (as shown in Fig 3), your method is getting “faded” – Smart Money has recognized the majority’s ways as an opportunity and started trading against it. You have probably heard the expression “gunning for stops” – this is exactly what is shown on Fig 3.

Fig 3. Original strategy is faded.

In order to incorporate this change in your strategy you are going to have to change your stop placement so that it is located under the point of reversal. It involves observations to spot the most probable level of reversal after hitting the stop. Obviously, you will also have to decrease your shares size since your stop became wider. I would call this action an attempt to escape Smart Money stop-gunning.

While this approach is acceptable to remain profitable, my heart goes to another method: an offensive approach. It essentially comes to placing yourself on the Smart Money side. This is where your strategy gets way more sophisticated. If you are in a choppy market where the breakouts are faded on a regular basis, start fading them instead of trading them – after all, pattern failure is a pattern, too. Or, if you are still in trending market but the pullbacks like the one on Fig 3 occur on a regular basis, change your entry idea: Instead of an entry at the breakout point, look for the reversal under the conventional stop placement level, to utilize this new pattern. This is a very powerful way to optimize your trading. By doing this, you place yourself against the crowd and side with Smart Money.

You can feel that this approach requires constant monitoring of market conditions and adds a certain creativity in your trading approach. This is exactly what separates a seasoned trader from an amateur: being in tune with the market, changing with it, spotting new opportunities and weeding out those that cease working.

Now, if you review the second paragraph of this article again, you will probably ask yourself: is it correct to say that the strategy stops or starts working again? This is a valid question and that’s why I put those expressions in quotes. A strategy never stops working – it changes the way it works, presenting you with a different set of opportunities.

0 Comments:

Post a Comment

<< Home