OK, he probably didn't write about trading... but you know, analogies can be found anywhere and often they help see things in the right perspective. So, here is this character, Gunslinger - hard-boiled, well-trained, capable of handling almost any situation he encounters, "hard caliber" as they call him. Facing quite complicated case with a lot of unknown interests involved, a lot of inter-connections, relationships and conflicts interlaced, he acts as if he sees it all clearly and can predict any turn of events. He in fact does - whatever happens, he already prepared the antidote. When questioned by his crew, he tells them that he knows in advance the rules by which this kind of situations evolve. "First smiles. Then lies. Last comes gunfire" is his template for it.

First analogy is simple and lies right on a surface. Pretty often intrigue with certain companies (and their stocks of course which is our subject of interest) resolve themselves in just this sequence. Remember Bre-X? First came smiles - everyone was in love with the story and stock which went from pennies to over $20. The lies flooded the cyberspace - all kinds of false reports, interviews, fabrication of samples, disappearance of main characters. Then gunfire started - disrobing, finding out the truth, courts, punishments. This is rather normal way of resolution of such intrigues and next time you come across something like this, you may want to remember Gunslinger's lesson and get out when smiles start fading out. You will be rewarded by saved profits, admiration of those around you and opportunity to shrug indifferently with "seen it all" face expression.

There is one more level in this analogy though. To the main character's friends his ability to foresee what happens next seemed almost supernatural. It was great intuition indeed - but what was it based on? On simple recognition of the situation. It's a newbie to whom every situation seems to be different. A seasoned trader has seen enough of them to catch the similarities and find the guidance in those. Over time, your arsenal of "been there, done that" situations will grow enabling you to recognize them and apply pre-canned response to them.

Random thoughts on trading caused by some analogy, typical conversation in a course of mentoring session or e-mail exchange. Typical trade development to learn from. In short - everything to do with educational side of trading. You won't find here market overviews or calls - there are enough blogs of this kind. Our calls are made real time on intraday basis and can be reviewed here. Welcome and feel free to participate.

Sunday, December 9, 2007

Thursday, November 22, 2007

What's In the Name, or What Is Tape Reading

Remember Dow theory? It talks, among other things, about waves. Were you ever told that in order to apply that theory you need to go to a shore? Probably not, noone is THAT literal. Well, almost... for some reason the term Tape Reading is being often read THAT literally. "Your book shows charts, not Times & Sales, hence it's CHART reading, not TAPE reading" - you wouldn't believe how many times I heard this. Ah, the way we name things and derive meaning from the names - it can be liberating or limiting, whichever you chose.

It makes no more sense than requirement to read the teletype tape instead of Times & Sales - after all, that was what original tape readers of 100 years ago used. Think about it: where does information on the chart come from? Is there anything to the chart but the graphic reflection of those same prints on the tape? Chart is nothing more than the way to visualize the tape. It's different medium for the same information. Now, which one is more convinient?

- In order to observe the tape (ticker, Times & Sales) you need to stare at it non-stop. Missed bit means gap in the information. Meanwhile chart allows you to look away - information is still there when you are back from the bathroom, just look again.

- In order to see what happened before you started watching your stock you simply look at the chart. With T&S what do you, scroll it back? And visualize all the price and volume changes?

- Try to watch the tape of, let's say RIMM or AAPL or AMZN. Wave of green... wave of red... mix... new wave... Do you buy and sell with each change? Fine if you are a tick-by-tick scalper, but what do you do if you are a daytrader? Or swing trader? What good will the tape do for you? You will have to drop this method of reading alttogether then - but its principles are applicable in any time frame, why limit yourself so severely? What could possibly so wrong with applying those principles to any timeframe you fancy by deploying... gasp... charts?

- Try to evaluate the strain you put on your brain by watching the ticker print by print. Fine if you are 22, full of energy and ambitions and intend to do it for a year or two. But if you are doing it for living, year after year - how long before you burn out? Don't forget, volume and speed at Jesse Livermore times were nowhere near what we have now.

- Ah, but what about classics? Isn't it sacrilege to apply their ideas to modern technology? Well, let's just see... I am opening my copy of Tape Reading and Market Tactics by Humphrey B. Neill - classic enough for ya? Image at the page 35 shows the ticker with purpose of explanation what symbols on it mean. Fine, thumbing along, next image (they are called Plates in the book, for overly literal types - those are not dishes) is at the page 63. Gasp... CHART!! US Steel, daily chart, 27 days in 1930, with closing prices and volume! Okay... what's next? Page 69, chart. Daily. Volume at the bottom part. Page 71, chart. 74, chart. 79. Hey, here is a ticker at the pages 83 and 84, only to illustrate particular moment of what is being discussed in the chapter and shown on two other charts, daily and intraday. That's it. The rest of the book is text and charts. Big sigh of relief - I am not overly sacrilegious.

Conclusion is obvious. Tape reading is a method that can and should be applied by using modern technology and more convinient way to visualize things. It doesn't necessary mean endless watching the tape itself without blinking.

Oh, and in case you are still not convinced - think of what you, if you insist to take terminology at face value, are supposed to do if you want to scalp the market...

It makes no more sense than requirement to read the teletype tape instead of Times & Sales - after all, that was what original tape readers of 100 years ago used. Think about it: where does information on the chart come from? Is there anything to the chart but the graphic reflection of those same prints on the tape? Chart is nothing more than the way to visualize the tape. It's different medium for the same information. Now, which one is more convinient?

- In order to observe the tape (ticker, Times & Sales) you need to stare at it non-stop. Missed bit means gap in the information. Meanwhile chart allows you to look away - information is still there when you are back from the bathroom, just look again.

- In order to see what happened before you started watching your stock you simply look at the chart. With T&S what do you, scroll it back? And visualize all the price and volume changes?

- Try to watch the tape of, let's say RIMM or AAPL or AMZN. Wave of green... wave of red... mix... new wave... Do you buy and sell with each change? Fine if you are a tick-by-tick scalper, but what do you do if you are a daytrader? Or swing trader? What good will the tape do for you? You will have to drop this method of reading alttogether then - but its principles are applicable in any time frame, why limit yourself so severely? What could possibly so wrong with applying those principles to any timeframe you fancy by deploying... gasp... charts?

- Try to evaluate the strain you put on your brain by watching the ticker print by print. Fine if you are 22, full of energy and ambitions and intend to do it for a year or two. But if you are doing it for living, year after year - how long before you burn out? Don't forget, volume and speed at Jesse Livermore times were nowhere near what we have now.

- Ah, but what about classics? Isn't it sacrilege to apply their ideas to modern technology? Well, let's just see... I am opening my copy of Tape Reading and Market Tactics by Humphrey B. Neill - classic enough for ya? Image at the page 35 shows the ticker with purpose of explanation what symbols on it mean. Fine, thumbing along, next image (they are called Plates in the book, for overly literal types - those are not dishes) is at the page 63. Gasp... CHART!! US Steel, daily chart, 27 days in 1930, with closing prices and volume! Okay... what's next? Page 69, chart. Daily. Volume at the bottom part. Page 71, chart. 74, chart. 79. Hey, here is a ticker at the pages 83 and 84, only to illustrate particular moment of what is being discussed in the chapter and shown on two other charts, daily and intraday. That's it. The rest of the book is text and charts. Big sigh of relief - I am not overly sacrilegious.

Conclusion is obvious. Tape reading is a method that can and should be applied by using modern technology and more convinient way to visualize things. It doesn't necessary mean endless watching the tape itself without blinking.

Oh, and in case you are still not convinced - think of what you, if you insist to take terminology at face value, are supposed to do if you want to scalp the market...

Sunday, November 18, 2007

Old Ways, New Results?

The dialog below is from recent mentoring session. Brief history: trader M. comes to critical junction in his trading career, as his losses accumulate over time to a point where he questions his ability to make money trading. The most frustrating thing is not even losses themselves but absence of any signs of improvement. In what can be viewed as one of last steps to save his trading carrer he ask me for a few mentoring sessions. During those we discover some flaws in his approach that put him on a losing side on regular basis. Exact character of those flaws is irrelevant to our today's blog post topic, suffice to say we are able to outline the plan and we agree to make an interruption for a week so M. could trade for a while armed by new understanding, then we are supposed to analyze the results, make corrections if needed, outline new steps if needed. Week goes by, we talk.

I: Sending me the log?

M: Nah, not yet.

I: Why not?

M: Well, I haven't implemented any of changes we discussed.

I: Why not?

M: Well, I lost so much earlier that I feel I need to get a solid chunk of it back first, then start changes.

I: Let's see if I got this right. You want to achieve better result by doing things the old way, way that haven't worked before; then, AFTER you achieve those better results, you want to implement the changes that are supposed to lead to those better results?

M: Hmmm... it doesn't make much sense when you put it this way.

At this point I realized that I actually did hear this before. Variations could be different, underlying message was the same. A trader blows his stops, holds his losing positions indefinitely until they hopefully come back; we discuss it, come to decision to free his mind and money by taking the losses and starting anew, he says "Fine, but first I will wait for this and this positions to come back, I need to recoup some of my losses". Another trader loses on his overnight holds regularly, we agree that he quits his positions before day's end so we could analyze his criteria for holding and decide whether to change them or maybe quit overnights altogether; he says "Fine, but this one I will hold, it looks so promising and I lost so much, I would like to get some back before starting major changes". See the similarity?

To me it sounds like this: You drive from A to B, it's a long drive, let's say 500 miles. At some point you discover that you took a wrong turn a while ago and last 200 miles you were going in a wrong direction. Instead of turning back and making the right turn this time, you decide to continue wrong way because YOU ALREADY LOST SO MUCH TIME AND FUEL THAT YOU WANT TO CONTINUE GOING THIS WAY UNTIL YOU ARRIVE AT THE POINT OF YOUR DESTINATION: ONLY AFTER YOU ARE THERE YOU AGREE TO TAKE THE RIGHT WAY.

If you ever catch yourself thinking like those traders described above, re-read this capitalized sentence above; see if it makes any sense to you.

I: Sending me the log?

M: Nah, not yet.

I: Why not?

M: Well, I haven't implemented any of changes we discussed.

I: Why not?

M: Well, I lost so much earlier that I feel I need to get a solid chunk of it back first, then start changes.

I: Let's see if I got this right. You want to achieve better result by doing things the old way, way that haven't worked before; then, AFTER you achieve those better results, you want to implement the changes that are supposed to lead to those better results?

M: Hmmm... it doesn't make much sense when you put it this way.

At this point I realized that I actually did hear this before. Variations could be different, underlying message was the same. A trader blows his stops, holds his losing positions indefinitely until they hopefully come back; we discuss it, come to decision to free his mind and money by taking the losses and starting anew, he says "Fine, but first I will wait for this and this positions to come back, I need to recoup some of my losses". Another trader loses on his overnight holds regularly, we agree that he quits his positions before day's end so we could analyze his criteria for holding and decide whether to change them or maybe quit overnights altogether; he says "Fine, but this one I will hold, it looks so promising and I lost so much, I would like to get some back before starting major changes". See the similarity?

To me it sounds like this: You drive from A to B, it's a long drive, let's say 500 miles. At some point you discover that you took a wrong turn a while ago and last 200 miles you were going in a wrong direction. Instead of turning back and making the right turn this time, you decide to continue wrong way because YOU ALREADY LOST SO MUCH TIME AND FUEL THAT YOU WANT TO CONTINUE GOING THIS WAY UNTIL YOU ARRIVE AT THE POINT OF YOUR DESTINATION: ONLY AFTER YOU ARE THERE YOU AGREE TO TAKE THE RIGHT WAY.

If you ever catch yourself thinking like those traders described above, re-read this capitalized sentence above; see if it makes any sense to you.

Tuesday, September 18, 2007

Death by a 1000 Cuts, Revisited

We already talked about this topic here. I've got another e-mail with the same question so maybe it's time to revisit the topic and give another way to look at it. Qucik reminder - this is a "scalping is a way to lose money by a thousand of papercuts" complaint.

Let me put it this way. What are your chances to win a lottery? Why, it's 100%. Don't beliee me? Think of it this way then: there are two events, A (your win) and B (your death). Of course you will win the lottery sooner or later, the real question is which of those events comes first. Now, back to trading: event A is your learning to make money in the market consistently, event B is you running out of money while on learning curve. Now, you can say that you lost money because of scalping no more than you can say that you lost because of swing trading. It's not the style of trading that leads to losses, it's trading in a wrong way that does. Trade correctly and you will make money in any style you fancy. Trade wrongly and you will lose - again, in any style you chose. By utilizing a style that accumulates losses quickly, however, you narrow your window of opportunity to learn - simply because you shorten the time till your account exhaustion and number of opportunities to enter and manage the trade. By going with style that increase both you have more time and opportunities to learn and hone your skills. Simple as that.

Oh, and in case you couldn't tell - yeah, I love scalping. Just make sure you know what I mean by it:

here and here

Let me put it this way. What are your chances to win a lottery? Why, it's 100%. Don't beliee me? Think of it this way then: there are two events, A (your win) and B (your death). Of course you will win the lottery sooner or later, the real question is which of those events comes first. Now, back to trading: event A is your learning to make money in the market consistently, event B is you running out of money while on learning curve. Now, you can say that you lost money because of scalping no more than you can say that you lost because of swing trading. It's not the style of trading that leads to losses, it's trading in a wrong way that does. Trade correctly and you will make money in any style you fancy. Trade wrongly and you will lose - again, in any style you chose. By utilizing a style that accumulates losses quickly, however, you narrow your window of opportunity to learn - simply because you shorten the time till your account exhaustion and number of opportunities to enter and manage the trade. By going with style that increase both you have more time and opportunities to learn and hone your skills. Simple as that.

Oh, and in case you couldn't tell - yeah, I love scalping. Just make sure you know what I mean by it:

here and here

Sunday, September 9, 2007

Costly hiccups - do YOU have any?

Summer fun seems to be nearing the end... wouldn't tell it by the weather, still great, but amount of e-mails increases greatly so probably time to come out of blissful unconsciousness... back to Earth.

One of the most frequent questions I get: "OK, I seem to have mastered a lot, I can extract money from the markets and I have stretch of winning days BUT... one day comes where I seem to be unable to follow my own rules, I start doing everything against what I learned, dig deeper and deeper hole... and when the day is over I find myself giving back all I made in a week before that! I feel groggy... then I remember everything I learned, pick myself up, glue pieces together, start trading carefully, start making money... only to have another blow-off just like the previous one in a week or two! What's going on, why can't I control myself and how do I avoid these frustrating days??"

If all above sounds familiar - it should. I didn't meet many traders who avoided this problem. Good news is, it's a somewhat good problem to have since it appears at the stage where your method is good enough and mastered well enough so you are able to make money consistently inbetween those disgusting days. Bad news is, there is no other way to overcome this problem but to understand the root of it. This, however, is true for all psychological barriers we encounter in trading - no magic button to push and turn the problem off, gotta understand where the problem stems from so you can recognize it when it re-appears and apply the right patch. And this problem is pure psychological - after all, what could change so drastically on the fifth day after four days of winning? Aside of your own behavior that is.

(There is a need to say some general words about trading psychology but let's do it in the next post.)

So, what gives? Why the Momentary Lapse Of Reason (yeah, I am old-fashioned enough to love Pink Floyd)?

Mechanics of this phenomenon are fairly intuitive. Remember the saying "When we succeed we tend to stop doing what made us asuccess in a first place"? This is exactly what happens here. As we make money day after day we start feeling invincible. Worst yet, subconsciously we start assigning the success to our genius. It's not the rules we follow. It's not the system we apply. It's not the favorable market (God forbid market helps us, we BEAT the market, we WIN against it! Right? Right?). It's US - we are above the rules, above the system, we are THE trader.

If you had to put all above in a single word, which one would you pick? Right. EGO. This eternal "enemy within" finds the way to undermine our success by convincing us we are second coming of Einstein. All this happens quietly, in the background, you don't even notice how paradigm changes... but it does, and somewhere deep inside you don't believe anymore rules apply to you.

Catastrophe comes with the next losing trade. Instead of taking our usual pre-determined stop we chose to ignore it. Why, we are the winner. We are having winning streak, uninterrupted for days. And since it's our genius that makes it happen, we won't lose this time too. Why take the loss, winning streak will continue. Rules are beneath us. Market be beaten and crying bitterly. We be laughing.

Know the rest, right? Stock continues against us. Either we take the loss finally, much bigger than the total of our losses for a week before... or we hold... oh, and by the way, while we fought this one, another trade came along, and we went for it, and it went in our favor, but we haven't taken the profit where we normally would. Why, we needed the size of win to be a bit bigger, to compensate for this darn stubborn losing trade... and new one reversed on us and became a loser too.

Long story short - when this day is over you dream of never waking up today. You think of how little your loss for the day would be should you take the stop. Worse yet, with that second trade you would even be positive for the day - providing you have taken the profit at your usual level. Instead, week worth of good careful trading is ruined. And why? Because you let your ego trade. It wasn't you who made that decision to break the rules. It was your ego. But it were you who let it. Don't. You are not above the market. You are not above the rules. When you win, it's not because your greatness makes the rules irelevant. You win because you follow the rules. Little humility will go a loooong way. Self-irony helps. As one of the best traders in our trading room says every time when congratulated with winning trade - "Lucky". And when pressed not to be so humble, adds: "Stops are skill. Wins are luck". Whether it's so or not is irrelevant. Self-irony and humility makes a trader. Oh, and bad spelling.

One of the most frequent questions I get: "OK, I seem to have mastered a lot, I can extract money from the markets and I have stretch of winning days BUT... one day comes where I seem to be unable to follow my own rules, I start doing everything against what I learned, dig deeper and deeper hole... and when the day is over I find myself giving back all I made in a week before that! I feel groggy... then I remember everything I learned, pick myself up, glue pieces together, start trading carefully, start making money... only to have another blow-off just like the previous one in a week or two! What's going on, why can't I control myself and how do I avoid these frustrating days??"

If all above sounds familiar - it should. I didn't meet many traders who avoided this problem. Good news is, it's a somewhat good problem to have since it appears at the stage where your method is good enough and mastered well enough so you are able to make money consistently inbetween those disgusting days. Bad news is, there is no other way to overcome this problem but to understand the root of it. This, however, is true for all psychological barriers we encounter in trading - no magic button to push and turn the problem off, gotta understand where the problem stems from so you can recognize it when it re-appears and apply the right patch. And this problem is pure psychological - after all, what could change so drastically on the fifth day after four days of winning? Aside of your own behavior that is.

(There is a need to say some general words about trading psychology but let's do it in the next post.)

So, what gives? Why the Momentary Lapse Of Reason (yeah, I am old-fashioned enough to love Pink Floyd)?

Mechanics of this phenomenon are fairly intuitive. Remember the saying "When we succeed we tend to stop doing what made us asuccess in a first place"? This is exactly what happens here. As we make money day after day we start feeling invincible. Worst yet, subconsciously we start assigning the success to our genius. It's not the rules we follow. It's not the system we apply. It's not the favorable market (God forbid market helps us, we BEAT the market, we WIN against it! Right? Right?). It's US - we are above the rules, above the system, we are THE trader.

If you had to put all above in a single word, which one would you pick? Right. EGO. This eternal "enemy within" finds the way to undermine our success by convincing us we are second coming of Einstein. All this happens quietly, in the background, you don't even notice how paradigm changes... but it does, and somewhere deep inside you don't believe anymore rules apply to you.

Catastrophe comes with the next losing trade. Instead of taking our usual pre-determined stop we chose to ignore it. Why, we are the winner. We are having winning streak, uninterrupted for days. And since it's our genius that makes it happen, we won't lose this time too. Why take the loss, winning streak will continue. Rules are beneath us. Market be beaten and crying bitterly. We be laughing.

Know the rest, right? Stock continues against us. Either we take the loss finally, much bigger than the total of our losses for a week before... or we hold... oh, and by the way, while we fought this one, another trade came along, and we went for it, and it went in our favor, but we haven't taken the profit where we normally would. Why, we needed the size of win to be a bit bigger, to compensate for this darn stubborn losing trade... and new one reversed on us and became a loser too.

Long story short - when this day is over you dream of never waking up today. You think of how little your loss for the day would be should you take the stop. Worse yet, with that second trade you would even be positive for the day - providing you have taken the profit at your usual level. Instead, week worth of good careful trading is ruined. And why? Because you let your ego trade. It wasn't you who made that decision to break the rules. It was your ego. But it were you who let it. Don't. You are not above the market. You are not above the rules. When you win, it's not because your greatness makes the rules irelevant. You win because you follow the rules. Little humility will go a loooong way. Self-irony helps. As one of the best traders in our trading room says every time when congratulated with winning trade - "Lucky". And when pressed not to be so humble, adds: "Stops are skill. Wins are luck". Whether it's so or not is irrelevant. Self-irony and humility makes a trader. Oh, and bad spelling.

Wednesday, July 18, 2007

How aggressive are you?

As we were going to, let's define different kinds of trade entry aggressiveness wise in order to know their advantages ands shortcomings. This will help you find what approach works better for your personal preferences and when to adjust things depending on the market behaviour.

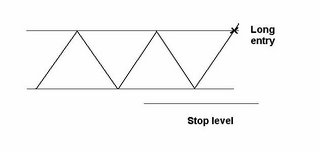

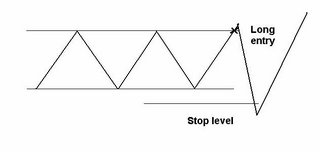

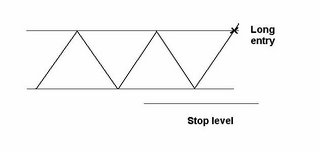

1. Regular entry.

This is an entry right at the trigger. If we are talking about breakout, regular entry will be just above the resistance level when it's broken. With Cup and handle forming day high at $20, tradeing at $20.01 will trigger the trade and be qualified as a regular entry.

Advantages:

- you enter a trade after getting your confirmation that a stock is capable of breaking the resistance, thus youre chance of profitable trade is higher

- this is popular spot for momentum players so you have a good chance of getting a quick scalp on the backs of slower traders or those entering at market

Shortcomings:

- as the crowd hits the stock at this level it can be hard to get your fill;

- your stop level is below the nearest support which is not necessary tight enough for your comfort

2. Aggressive entry

This is an entry in advance, closer to support level counting on future breakout

In the same Cup and Handle example, with breakout point at $20 and cup bottom at $19.80 you enter as close to 19.80 as possible when a stock shows strength.

Advantages:

- very tight stop as your entry is fairly close to support level

- easy to get your order filled as the crowd is not really active at this point and is likely to engage on an actual breakout

- better risk/reward ratio

- opportunity to dump your shares near breakout level if you lose faith in it and still be profitable

- more manoeuvrability as you can partial out near the breakout level securing part of profit and let the other part trade to catch more on a break if it occurs

Shortcomings:

- less confidence in a breakout as you have no confirmation

- your stops will be tighter but there will be more of them

3. Conservative entry

This is an entry where you let the trigger go, wait out first spike and try to get in on a pullback IF new support level (former resiatnce) is holding. Citing the same example uniformity sake, that Cup and Handle break of $20 will lead you into watching a stock breaking, making new high and retreating to $20, where you will enter on a first sign of strenghtening with stop under $20.

Advantages:

- you get as much confirmation as possible by seeing a stock not only being capable to break the resistance but also holding above it on a pullback

- stop is fairly tight

- entry is relatively easy as you hit it at the point of uncertainty on a pullback which usually offers a pause

Shortcomings:

- there is a good chance to miss an entry altogether if a stock moves too far after a break never looking back

- less favorable entry price

There is no better or worse way to apply those. Obviously two major factors in deciding between them are your personal preferences and the kind of market you are in.

Some of my personal points:

Most often I go for aggressive and regular entries. The stronger market is the more aggressive my entries are. The less confident about certain stock I am, the more likely I am to go for conservative entry. The more volatile stock is, the more likely I am to go for aggressive entry to minimize "natural-volatility shakeout" often occuring on a break itself.

1. Regular entry.

This is an entry right at the trigger. If we are talking about breakout, regular entry will be just above the resistance level when it's broken. With Cup and handle forming day high at $20, tradeing at $20.01 will trigger the trade and be qualified as a regular entry.

Advantages:

- you enter a trade after getting your confirmation that a stock is capable of breaking the resistance, thus youre chance of profitable trade is higher

- this is popular spot for momentum players so you have a good chance of getting a quick scalp on the backs of slower traders or those entering at market

Shortcomings:

- as the crowd hits the stock at this level it can be hard to get your fill;

- your stop level is below the nearest support which is not necessary tight enough for your comfort

2. Aggressive entry

This is an entry in advance, closer to support level counting on future breakout

In the same Cup and Handle example, with breakout point at $20 and cup bottom at $19.80 you enter as close to 19.80 as possible when a stock shows strength.

Advantages:

- very tight stop as your entry is fairly close to support level

- easy to get your order filled as the crowd is not really active at this point and is likely to engage on an actual breakout

- better risk/reward ratio

- opportunity to dump your shares near breakout level if you lose faith in it and still be profitable

- more manoeuvrability as you can partial out near the breakout level securing part of profit and let the other part trade to catch more on a break if it occurs

Shortcomings:

- less confidence in a breakout as you have no confirmation

- your stops will be tighter but there will be more of them

3. Conservative entry

This is an entry where you let the trigger go, wait out first spike and try to get in on a pullback IF new support level (former resiatnce) is holding. Citing the same example uniformity sake, that Cup and Handle break of $20 will lead you into watching a stock breaking, making new high and retreating to $20, where you will enter on a first sign of strenghtening with stop under $20.

Advantages:

- you get as much confirmation as possible by seeing a stock not only being capable to break the resistance but also holding above it on a pullback

- stop is fairly tight

- entry is relatively easy as you hit it at the point of uncertainty on a pullback which usually offers a pause

Shortcomings:

- there is a good chance to miss an entry altogether if a stock moves too far after a break never looking back

- less favorable entry price

There is no better or worse way to apply those. Obviously two major factors in deciding between them are your personal preferences and the kind of market you are in.

Some of my personal points:

Most often I go for aggressive and regular entries. The stronger market is the more aggressive my entries are. The less confident about certain stock I am, the more likely I am to go for conservative entry. The more volatile stock is, the more likely I am to go for aggressive entry to minimize "natural-volatility shakeout" often occuring on a break itself.

Friday, July 6, 2007

A Bit About IF and THEN

The idea of IF-THEN scenarios in trading is often misconstrued one. I often see it being interpreted in a sense of predicting stock's action. A trader trying to apply it in this sense tries to think in terms 'If a stock does this, it's going to do that". This approach is more acceptable if a trader thinks in terms of probability instead of certainty in which case the above sentence becomes "If a stock does this, it's likely to do that". Nothing's wrong with that as long as a trader realizes that probability is just that - a probability that is going to work in a statistically valid number of samples but will not predict the outcome of each given case.

I, however, apply IF-THENs in a slightly different manner. For me it's about defining my own action in response to market fluctuations. My IF-THEN is a scenario where IF is what market does and THEN is what I do in response. My intepretation thus becomes 'If a stock does this, I do that".

Certainly, it's a derivation of the version above - you can arrive to it from "if a stock does this then it's likely to do that, so I am going to react in such and such way". My version is just more cut and dry.

What are the advantages of this aproach and why do we need to build a set of such scenarios?

First, it takes guessing and predicting out of the equation. Our trading becomes more systematic as we look for recognizable situation for which we have a pre-canned response.

Second, it takes emotions out of the equation. Since our actions are pre-determined, we simply apply them to what happens. Stock does this - we do that. No room for emotions, no room for surprize (well, almost - market has ways to offer something unseen before even when you think you have seen it all, LOL).

Third, it takes ego out of the equation. Since you are not trying to predict future events, there is no ego involvement in case if a stock does something unexpected. You didn't expect anything, right? You were simply waiting for it to do something in order to react in that pre-canned way. Since ego is not there to make you feel hurt, you have no problem with taking your stop - it's just one of the prepared scenarios. You don't feel as if you were proven wrong - you didn't commit to any prediction, so you can't be right or wrong.

All above makes you kind of trading robot. See setup - take setup, see action - apply reaction. Eyes to finger, no brain inbetween. Sounds boring? Great. I trade for profit, not for excitement. No brain involvement is a side benefit, you feel fresh and rested when the trading day is over.

I can assure you, it's a very liberating state of mind. Once you experience it, you never want to go back to old "highly-strung overthinking it" ways.

I, however, apply IF-THENs in a slightly different manner. For me it's about defining my own action in response to market fluctuations. My IF-THEN is a scenario where IF is what market does and THEN is what I do in response. My intepretation thus becomes 'If a stock does this, I do that".

Certainly, it's a derivation of the version above - you can arrive to it from "if a stock does this then it's likely to do that, so I am going to react in such and such way". My version is just more cut and dry.

What are the advantages of this aproach and why do we need to build a set of such scenarios?

First, it takes guessing and predicting out of the equation. Our trading becomes more systematic as we look for recognizable situation for which we have a pre-canned response.

Second, it takes emotions out of the equation. Since our actions are pre-determined, we simply apply them to what happens. Stock does this - we do that. No room for emotions, no room for surprize (well, almost - market has ways to offer something unseen before even when you think you have seen it all, LOL).

Third, it takes ego out of the equation. Since you are not trying to predict future events, there is no ego involvement in case if a stock does something unexpected. You didn't expect anything, right? You were simply waiting for it to do something in order to react in that pre-canned way. Since ego is not there to make you feel hurt, you have no problem with taking your stop - it's just one of the prepared scenarios. You don't feel as if you were proven wrong - you didn't commit to any prediction, so you can't be right or wrong.

All above makes you kind of trading robot. See setup - take setup, see action - apply reaction. Eyes to finger, no brain inbetween. Sounds boring? Great. I trade for profit, not for excitement. No brain involvement is a side benefit, you feel fresh and rested when the trading day is over.

I can assure you, it's a very liberating state of mind. Once you experience it, you never want to go back to old "highly-strung overthinking it" ways.

Thursday, June 28, 2007

Method to Madness III

Let's break the setup down to elements so we can define our actions in terms of that setup and price actions.

First, setup must have a trigger. Trigger will define a point of entry. In terms of breakout setup for instance, a trade above the established resistance level is a trigger for our entry for a trend continuation.

Second, setup must have a failure indication. This indication will give us an idea for a stop placement. Again, if we are talking about breakout setup, such indication would be a loss of a support level.

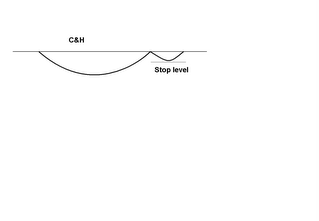

Putting these two together, we have an entry and risk control. To illustrate it on a particular chart formation, let's have a look at the Cup and Handle. Rim level defines a resistance to break while handle's bottom defines the closest support. Our trigger for an entry is going to be a trade above the rim level, while our stop will be located under the handle bottom.

Third, setup usually has certaing supporting factors that are in fact parts of the setup. One of the most useful is volume configuration. You want volume to support your chosen direction by increasing as a stock inches toward a breakout level and drying up during a retreat. Among other supporting factors you may want to list a broader market directional support, or cetain technical study you utilize.

Fourth, you need an idea of an exit level on a profit side. This is where your particular setup intersects with your chosen style of trading and method of reading. You remember the discussion of risk/reward ratio in articles on scalping. If you aim for 1:1 ratio, you will look for a signs of exit around that level. What are those signs? That depends on your method of reading - for instance as a tape reader you will look for a sharp price spike combined with volume increase as this combination usually signals an end of a current stage of a movement. If you use certain technical indicator, you will watch for it to show the exaustion of the movement. The important thing here is a logical alignment between the tools that you use for an entry and exit indication. While it should be self-explanatory, I will mention and example of horrible misalignment, simply because I do see this happening with some traders. If you find your entry on a daily chart using japanese candlesticks and look for an exit using MACD on one-minute chart, you ask for troubles.

Finally, fifth element of your setup structure is a fine-tuning of an entry in terms of aggressiveness. While there is a trigger for a trade, you may find that in certain markets entry in advance works better. Entering on a trigger would be a regular way to initiate the trade. Entry in advance counting on a future trigger would constitute an aggressive way which offers its trade-offs. Finally, there is a conservative way to enter which would mean letting a trigger go and entering later on if certain conditions are met. There are trade-offs to this way, too. Let's make it a matter of a ceparate post. For now, you are armed with the way to structure your setup so you have your actions defined by what's happening with your stock. Your ultimate plan of action can now be put in terms of IF-THEN scenario where each IF is a market action and each THEN is your response. This offers you a lot more than just entry and exit points, and this is what we discuss in our next post.

First, setup must have a trigger. Trigger will define a point of entry. In terms of breakout setup for instance, a trade above the established resistance level is a trigger for our entry for a trend continuation.

Second, setup must have a failure indication. This indication will give us an idea for a stop placement. Again, if we are talking about breakout setup, such indication would be a loss of a support level.

Putting these two together, we have an entry and risk control. To illustrate it on a particular chart formation, let's have a look at the Cup and Handle. Rim level defines a resistance to break while handle's bottom defines the closest support. Our trigger for an entry is going to be a trade above the rim level, while our stop will be located under the handle bottom.

Third, setup usually has certaing supporting factors that are in fact parts of the setup. One of the most useful is volume configuration. You want volume to support your chosen direction by increasing as a stock inches toward a breakout level and drying up during a retreat. Among other supporting factors you may want to list a broader market directional support, or cetain technical study you utilize.

Fourth, you need an idea of an exit level on a profit side. This is where your particular setup intersects with your chosen style of trading and method of reading. You remember the discussion of risk/reward ratio in articles on scalping. If you aim for 1:1 ratio, you will look for a signs of exit around that level. What are those signs? That depends on your method of reading - for instance as a tape reader you will look for a sharp price spike combined with volume increase as this combination usually signals an end of a current stage of a movement. If you use certain technical indicator, you will watch for it to show the exaustion of the movement. The important thing here is a logical alignment between the tools that you use for an entry and exit indication. While it should be self-explanatory, I will mention and example of horrible misalignment, simply because I do see this happening with some traders. If you find your entry on a daily chart using japanese candlesticks and look for an exit using MACD on one-minute chart, you ask for troubles.

Finally, fifth element of your setup structure is a fine-tuning of an entry in terms of aggressiveness. While there is a trigger for a trade, you may find that in certain markets entry in advance works better. Entering on a trigger would be a regular way to initiate the trade. Entry in advance counting on a future trigger would constitute an aggressive way which offers its trade-offs. Finally, there is a conservative way to enter which would mean letting a trigger go and entering later on if certain conditions are met. There are trade-offs to this way, too. Let's make it a matter of a ceparate post. For now, you are armed with the way to structure your setup so you have your actions defined by what's happening with your stock. Your ultimate plan of action can now be put in terms of IF-THEN scenario where each IF is a market action and each THEN is your response. This offers you a lot more than just entry and exit points, and this is what we discuss in our next post.

Sunday, June 17, 2007

Method to Madness II

So, how do you go about structuring your trading? First thing to ask yourself is, what kind of movement are you going to play? Trend following? Trend reversal? Range? This is going to define the kind of setups you are going to look for. Let's try to give some examples.

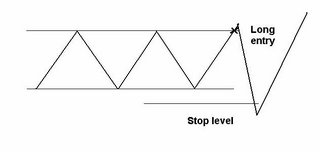

If you are playing trend following, you are going to look for breakout setups (breakdown too if playing short side, but let's limit it to long simplicity sake). In terms of chart formations for instance, you are going to look for Cup and Handle, JBE, Ascending Triangle etc. If you prefer candlestick formations, you will select those that reflect trend continuation; similarly, with any other study or indicator you want to use, you will be concentrating on those that match your chosen type of the movement. I am staying with chart formations in this example because is easier to envision and this is going to come handy when we finally get to particular setup structure.

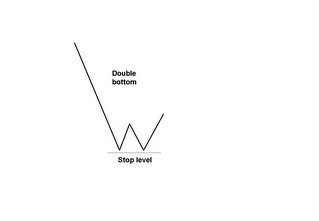

If you decide to focus on trend reversal, you will be on hunt for Double Bottom, Head and Shoulders. Finally, if you want to play range, you will look for, well, range - price locked in a certain horisontal limits.

Out of the universe of setups, you will pick several that match your approach. 3? 5? About that, and could be just a couple at the beginning. No point in starting out with 10, you will get lost in their variations. If this step in structuring your trading feels like a small one, it's a misconception. What you just did is a big step: you made a transition from a very general idea (kind of movements to trade) to a very particular thing (exact setups to learn and to hunt for). However mundane the task of matching one to another seems, you would be amazed by how many say they want to trade trend continuation and go ahead looking for double bottoms or tops.

What we are going to do in the next post on this topic is to start structuring our setups - break them down by elements and see how you put those elements together in order to come to a logical, meaningful, structured and controllable way to trade.

If you are playing trend following, you are going to look for breakout setups (breakdown too if playing short side, but let's limit it to long simplicity sake). In terms of chart formations for instance, you are going to look for Cup and Handle, JBE, Ascending Triangle etc. If you prefer candlestick formations, you will select those that reflect trend continuation; similarly, with any other study or indicator you want to use, you will be concentrating on those that match your chosen type of the movement. I am staying with chart formations in this example because is easier to envision and this is going to come handy when we finally get to particular setup structure.

If you decide to focus on trend reversal, you will be on hunt for Double Bottom, Head and Shoulders. Finally, if you want to play range, you will look for, well, range - price locked in a certain horisontal limits.

Out of the universe of setups, you will pick several that match your approach. 3? 5? About that, and could be just a couple at the beginning. No point in starting out with 10, you will get lost in their variations. If this step in structuring your trading feels like a small one, it's a misconception. What you just did is a big step: you made a transition from a very general idea (kind of movements to trade) to a very particular thing (exact setups to learn and to hunt for). However mundane the task of matching one to another seems, you would be amazed by how many say they want to trade trend continuation and go ahead looking for double bottoms or tops.

What we are going to do in the next post on this topic is to start structuring our setups - break them down by elements and see how you put those elements together in order to come to a logical, meaningful, structured and controllable way to trade.

Friday, June 8, 2007

Cure for guilt

If I ever feel guilty about not posting anything for a few days, I go out and look at this. Guilt is cured.

Sunday, June 3, 2007

Surgeons, dentists and... traders

Those of you who read my books and/or listened to my periodic rants on trading psychology topics remember analogy I use frequently when discuss the idea of focussing on trading right and not on making money. For those who haven't, brief outline: the idea is to focus on doing things right and to perceive money as a reward for the job well done, as opposite to being focused on making money which serves as nothing but distraction from the following the rules, working out correct strategy etc - because the matter to focus on is reading the market movement and exploiting it. The analogy I like to use in order to make the meanbing clear is one of a surgeon who, in order to be a good one, must focus on performing the procedure right and not on the money he is going to obtain for the surgery performed. And if he does think of his reward while working on you, do you really want to be his patient, do you have full confidence in his ability to deliver the result? If the answer is NO, as it well should be, then the reason for such answer is very clear: our surgeon is not focused on the subject of his job which is not the money - just as a subject of a trader's job is a market movement, not the money.

So, yesterday I am having a dinner with a small group of friends one of whom is a dentist of huge experience, many decades in the field, creator and a head of various governmental programs, inventor of new technologies, highly respected by colleagues etc etc. Conversation touches on education, the ways to bring up new generations of trained professionals, he talks about his teachers, tells stories from his student past... Now, can you imagine how fascinated I was when he told about one teacher of his who would say often: Do not focus on money, do not see your patient as a cash register, think of doing your job right, focus on that and money will follow...

Seems to be universal principle, doesn't it :)

So, yesterday I am having a dinner with a small group of friends one of whom is a dentist of huge experience, many decades in the field, creator and a head of various governmental programs, inventor of new technologies, highly respected by colleagues etc etc. Conversation touches on education, the ways to bring up new generations of trained professionals, he talks about his teachers, tells stories from his student past... Now, can you imagine how fascinated I was when he told about one teacher of his who would say often: Do not focus on money, do not see your patient as a cash register, think of doing your job right, focus on that and money will follow...

Seems to be universal principle, doesn't it :)

Saturday, May 26, 2007

Thursday, May 24, 2007

Method to Madness

"Though this be madness, yet there is method in it."

Polonius, Hamlet by William Shakespeare

Couple posts ago I promised to return to the idea of the setup's structure. In order to come to it, however, I need to start with more broad theme - one of the adjustment and re-adjustment to changing conditions. Here is where the importance of the topic stems from: for many trading presents enormous difficulties because market is an unstructured environment. We are not readily wired to act correctly under such conditions. Our comfort zone lies in having schedules, guides, instructions, manuals, road maps and signs. When we are not familiar with the structure of our surroundings, we overcome the difficulties by learning it - looking at the map, reading the manual... but what do you do when you need to act with certainty in uncertain environment? Environment that changes by minute, by day, presenting new challenges, obeying new rules, being influenced by new factors? You work out the method to your own actions. You create algorythm which governs not only your course of action but also your course of adjustment - the way you change your behavior when the surroundings change. Those who trade long enough know very well how often they had to adjust to constant change. Fractions to decimals, anyone? 25K rule? Order routing? Bull to bear to lull?

This kind of changes for an experienced trader is similar to finding a new route for his routine trip when city authorities close the road for renovation. Not a biggie, right? Inconvinient, sometimes time-consuming but not a big deal. However, for a newer trader starting out in this profession the analogy would be more dramatic. Moving from a ghost town in prairies to New York perhaps? Let's throw in different language, absence of any prior information of what the big city is about, unfamiliarity with the concept of municipal transport and apartment buildings... now we are talking. Total chaos, no structure to dictate your action, strange life seethes around... and you need to do something. Will your first steps be the right ones? Most likely not. They will be much better when you learn the structure of what's going on, what elements are there and how they interact. This is what a trader starts with as well - providing he or she realizes the need to learn instead of diving in headfirst (always amazes me how many do just that, what is it about this profession that makes it look like it can be mastered without learning??).

So, you start with attempting to learn more about markets... and wierd thing happes - it doesn't get you anywhere. You just mastered the concept of earning announcements, EPS, price to earnings, learned to read balance sheets, you feel like deep dark secrets known to few have been opened for you... yet price action doesn't match your expectations. Wait, but what happened to our analogy? Learning the layout of the streets in your new city and what transport is available and what its schedule is, wouldn't you become capable of getting around? You would - but the analogy has ended earlier. It described your lack of understanding of what was happening around you, and that's it. Major differencies started after that - city is STRUCTURED. Markets are NOT. Not in the way you expect them to be, anyway.

Next thing that is likely to happen to you is getting familiar with technical analysis. Ahhh, that's where the problem was - there is this voodoo that for some reason impacts the movement... or does it? Or does it just reflect the movement in a certain visual way providing some hints for a scholar? Those are questions you start encountering while studying MAs, BBs, dark clouds and hanging men hit by shooting stars, and all other dolls and pins also known as studies and indicators. Your knowledge grows by day... does your trading account? Ummm... most likely not.

By no means do I want to say that all I listed above is not needed. Why, all this learning is necessary, or at least some elements of it - I for one still wouldn't be able to tell the balance sheet of Microsoft from one of Bre-X. It's just that it's not enough - not until you create YOUR OWN METHOD. Remember our very first article in this blog? We talked about indicators not being able to create profit by themselves and serving only as a tool. This is where we return to this theme. All this learning provided you not with answers but with tools to get them. No hammer goes ahead and drives nails in the wood without you. It just provides you with means to do just that. Now it's time to create your trading approach utilizing those tools. What kind of hammer do you need for the job? How do you hold it? How do you swing it? What kind of nails? Answer these questions, practice a bit and your nails hold two wooden details together.

What kind of questions do you ask (and answer) in order to create your trading system? And finally, how do you form your setups and what is their structure? Next post.

Polonius, Hamlet by William Shakespeare

Couple posts ago I promised to return to the idea of the setup's structure. In order to come to it, however, I need to start with more broad theme - one of the adjustment and re-adjustment to changing conditions. Here is where the importance of the topic stems from: for many trading presents enormous difficulties because market is an unstructured environment. We are not readily wired to act correctly under such conditions. Our comfort zone lies in having schedules, guides, instructions, manuals, road maps and signs. When we are not familiar with the structure of our surroundings, we overcome the difficulties by learning it - looking at the map, reading the manual... but what do you do when you need to act with certainty in uncertain environment? Environment that changes by minute, by day, presenting new challenges, obeying new rules, being influenced by new factors? You work out the method to your own actions. You create algorythm which governs not only your course of action but also your course of adjustment - the way you change your behavior when the surroundings change. Those who trade long enough know very well how often they had to adjust to constant change. Fractions to decimals, anyone? 25K rule? Order routing? Bull to bear to lull?

This kind of changes for an experienced trader is similar to finding a new route for his routine trip when city authorities close the road for renovation. Not a biggie, right? Inconvinient, sometimes time-consuming but not a big deal. However, for a newer trader starting out in this profession the analogy would be more dramatic. Moving from a ghost town in prairies to New York perhaps? Let's throw in different language, absence of any prior information of what the big city is about, unfamiliarity with the concept of municipal transport and apartment buildings... now we are talking. Total chaos, no structure to dictate your action, strange life seethes around... and you need to do something. Will your first steps be the right ones? Most likely not. They will be much better when you learn the structure of what's going on, what elements are there and how they interact. This is what a trader starts with as well - providing he or she realizes the need to learn instead of diving in headfirst (always amazes me how many do just that, what is it about this profession that makes it look like it can be mastered without learning??).

So, you start with attempting to learn more about markets... and wierd thing happes - it doesn't get you anywhere. You just mastered the concept of earning announcements, EPS, price to earnings, learned to read balance sheets, you feel like deep dark secrets known to few have been opened for you... yet price action doesn't match your expectations. Wait, but what happened to our analogy? Learning the layout of the streets in your new city and what transport is available and what its schedule is, wouldn't you become capable of getting around? You would - but the analogy has ended earlier. It described your lack of understanding of what was happening around you, and that's it. Major differencies started after that - city is STRUCTURED. Markets are NOT. Not in the way you expect them to be, anyway.

Next thing that is likely to happen to you is getting familiar with technical analysis. Ahhh, that's where the problem was - there is this voodoo that for some reason impacts the movement... or does it? Or does it just reflect the movement in a certain visual way providing some hints for a scholar? Those are questions you start encountering while studying MAs, BBs, dark clouds and hanging men hit by shooting stars, and all other dolls and pins also known as studies and indicators. Your knowledge grows by day... does your trading account? Ummm... most likely not.

By no means do I want to say that all I listed above is not needed. Why, all this learning is necessary, or at least some elements of it - I for one still wouldn't be able to tell the balance sheet of Microsoft from one of Bre-X. It's just that it's not enough - not until you create YOUR OWN METHOD. Remember our very first article in this blog? We talked about indicators not being able to create profit by themselves and serving only as a tool. This is where we return to this theme. All this learning provided you not with answers but with tools to get them. No hammer goes ahead and drives nails in the wood without you. It just provides you with means to do just that. Now it's time to create your trading approach utilizing those tools. What kind of hammer do you need for the job? How do you hold it? How do you swing it? What kind of nails? Answer these questions, practice a bit and your nails hold two wooden details together.

What kind of questions do you ask (and answer) in order to create your trading system? And finally, how do you form your setups and what is their structure? Next post.

Wednesday, May 23, 2007

Let's Add Voice to the Text!

Yesterday I gave little interview to Tim Bourquin, Founder and CEO of http://www.traderinterviews.com/ . Knowing Tim for many years now, I am not in the least surprized by the quality of the site. Top notch material, rich and innovative. Have a look at http://www.traderinterviews.com/idealab while browsing the site.

You can listen to the interview here

You can listen to the interview here

Saturday, May 19, 2007

A Trader's Development

We had an interesting exchange in the trading room on Friday, discussing a trader's development, things to focus on, typical mistakes etc. This kind of discussions breaks out now and then amidst all the market chatter and particular calls. It presents invaluable opportunity to review one's path and make necessary corrections, mostly because, unlike generic books and articles, this kind of discussions is usually triggered by particular question, thus becoming very relevant and personalized. Check it out in our trading log (link on the right under Education tab) for May 18, from 9:58 to 10:30 (times are PST).

Thursday, May 10, 2007

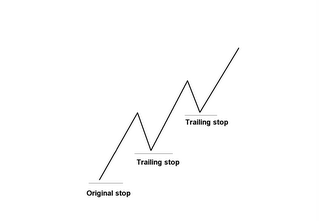

STOPS: Why Don't We Keep Them

With everything said and written on the subject of stops, it should be given that everyone is conditioned to keep them religiously even before they start trading. No matter what source a newer trader turns to, utter importance of stops will be underlined and emphasized up to the degree that keeping them is heralded as the ultimate key to success. We all heard adages like “Take care of your losses, profits will take care of themselves”.

Do all the stern warnings work? Not really.

Time and again traders blow their stops, widen them in a course of a trade, hold losing position in a false hope it will make them whole. If this destructive behavior continues despite all the warnings, there must be deeply rooted reasons for this. As with most trading flaws, failure to keep stops roots in fundamental misconceptions about the very nature of the market and trading. Such misconceptions cause incorrect psychological makeup which, in turn, results in behavioral patterns harmful for a trader’s performance. In order to re-condition oneself it is necessary to work out fundamental, even philosophical if you will, understanding of the market as an environment in which a trader operates.

Let us list and analyze the misconceptions that cause failure to keep stops.

Right action must result in profit.

This misconception stems from misunderstanding of the very nature of the market as an uncertain environment. Newer trader sees a market as a conglomerate of firm links between reasons and outcomes. In such a conglomerate, every reason results in single possible outcome. The simplest case of such link would be “good news – up, bad news – down”. We know it’s not true – price reacts to news in a wide variety of ways.

Similarly, an inexperienced trader applying the setup he knows “should work” expects every trade to be a winner, providing all the components of the setup are right. Have you ever heard complaints like “Everything was exactly like in that book, yet the trade failed”? That is direct result of this misunderstanding. Everything may be right, yet the trade fails – just because markets work in probabilities and not in certainties.

If a system produces certain percentage of wins over time, it’s just statistics – and, as it is always the case with statistics, it cannot predict an outcome of a particular trade. No matter how good the setup is, any given trade can fail. That’s why it’s imperative for a trader to distinguish between two kinds of losses.

The first kind is a loss caused by a trader’s mistake – failure to follow all the rules of system applied, or impulsive entry without any reason at all. Such losses must be taken as a lesson. The second kind is the case where every piece of puzzle was in place, yet the trade failed – such losses must be written off as a part of trading game, as a tribute to uncertainty of the markets.

Of course, if you identify a component of your trading system that regularly causes trade failure, you can and should tweak your system in order to minimize failures. However, during the trade a stop must be taken as soon as signal of failure appears. The line of thinking “The setup was so good, it must work eventually” is a disaster waiting to happen.

Failure to perceive the market as an uncertain environment can result in another misconception:

Losses can be eliminated.

In a paradoxical way, this erroneous notion leads to more losses. A trader tweaks his system endlessly trying to get rid of losses completely. In such constant adjusting and re-adjusting, the system evolves into something totally different, losing its original logic, or even stops producing entry signals at all. As a result, a trader either abandons his system, which was not a bad one to begin with, or in a worst case, simply refuses to take losses. After all, he made his system so perfect by eliminating all the reasons for failures, it just MUST work! Meanwhile, had he stayed with original approach, maybe with some minor tweaks, it would continue producing steady results.

My trade is who I am.

This is one of those hidden subconscious misconceptions that cause us to refuse to take our stop. A trader perceives the result of his trade as a reflection of his personality, his abilities. A trade failure makes him feel as though he is a failure. Winning makes him feel "right", while losing makes him feel "wrong". Nobody likes to be a failure, to be wrong. That’s why, in order to avoid being wrong, we refuse to take our stop. You can be right and still lose on this particular trade. You can be wrong and win, too.

It’s important to differ between good and bad trade, and we will be back to this later, in the Random reinforcement part. At this point it’s important to separate your self-perception from the result of your trade. Taking a stop loss, you are stopping your loss – nothing foolish about that. The major trigger for the right approach here is a realization that by accepting the market as an uncertain environment, we already have accepted the possibility of losses. If we haven’t expected the market to work in our favor every time, there is no reason to feel foolish when it doesn’t.

A loss is just a paper loss until it’s taken.

This is a big mistake in thinking. If a loss gets out of hand, it’s very real. It paralyzes you, it clouds your judgment, and it makes you miss plenty of other opportunities. Instead of taking a pre-determined loss and moving on to another trade, you sit and watch your losing one, twitching in pain and feeling remorse. Your chance to take a small stop is long gone. You are agonizing now over big one that is going to deplete your account too much and inflict serious emotional wounds. You hardly notice many other opportunities. The market has moved on, other sectors and stocks are in play, and you still nurture your losing trade, hating it and not being able to finally drop it. At some point you will ask yourself "Why was this trade so important to me? What made me hold onto it?" And this takes us to the next common error:

Putting too much importance into single trade.

A newer trader tends to see each trade as overly important, as if it’s going to make or break him. The market is an endless stream of opportunities. The next trade is right around the corner. No single trade is so important that it would be worth abandoning all other opportunities. Perceive your trading as a process, not as separate events. With the correct approach trading becomes natural, like breathing. Each entry is inhale, each exit is exhale. Breathe in and breathe out. Don’t choke yourself trying to hold onto each given breath.

Random reinforcement.

This is an important concept to understand. The market is not always rewarding right decisions and punishing bad ones. The practical implication is that a trader runs a risk to stop applying proper techniques if he sees wrong ones being rewarded sometimes. Take a stop, observe a stock reversing and going into profit zone – and you get tempted to skip your stop next time. If you try it and it works, there is significant chance that you continue doing just that – the bad habit gets reinforced. You may win several times by breaking your rules. What happens eventually is that one trade that does not reverse destroys your account. It’s important to define what good and bad trades are. Unlike many think, a good trade is not always a winning trade; a bad trade is not always a losing trade.

- A good trade is a trade where you kept all your rules that you know to be working in a long run. A good trade can be a winning one when the market acts accordingly to what your system indicates. It can be a losing trade when the market acts against it, but it’s still a good trade.

- A bad trade is a trade made against your better judgment, against your rules. It can be a losing trade when a market acts as it “should”. It can be a winning trade when the market rewards your bad judgment, and it can be a very dangerous trap as a bad habit gets reinforced.

The last thing to say in conclusion is that a certain psychological barrier for a trader to overcome to start applying his stops with no hesitation. When this barrier is taken, things suddenly become so clear and automatic that a trader can’t even believe it was ever a problem for him. When this barrier is overcome, you feel that stops became natural part of your trading, that you take them with no slightest hesitation and forget about them instantly, moving on to search for your next trade, that taking stops do not trigger any negative emotions. This is wonderful feeling of total self-control. Not only will it do plenty of good to your trading performance, it’s a very rewarding feeling in itself.

Do all the stern warnings work? Not really.

Time and again traders blow their stops, widen them in a course of a trade, hold losing position in a false hope it will make them whole. If this destructive behavior continues despite all the warnings, there must be deeply rooted reasons for this. As with most trading flaws, failure to keep stops roots in fundamental misconceptions about the very nature of the market and trading. Such misconceptions cause incorrect psychological makeup which, in turn, results in behavioral patterns harmful for a trader’s performance. In order to re-condition oneself it is necessary to work out fundamental, even philosophical if you will, understanding of the market as an environment in which a trader operates.

Let us list and analyze the misconceptions that cause failure to keep stops.

Right action must result in profit.

This misconception stems from misunderstanding of the very nature of the market as an uncertain environment. Newer trader sees a market as a conglomerate of firm links between reasons and outcomes. In such a conglomerate, every reason results in single possible outcome. The simplest case of such link would be “good news – up, bad news – down”. We know it’s not true – price reacts to news in a wide variety of ways.

Similarly, an inexperienced trader applying the setup he knows “should work” expects every trade to be a winner, providing all the components of the setup are right. Have you ever heard complaints like “Everything was exactly like in that book, yet the trade failed”? That is direct result of this misunderstanding. Everything may be right, yet the trade fails – just because markets work in probabilities and not in certainties.

If a system produces certain percentage of wins over time, it’s just statistics – and, as it is always the case with statistics, it cannot predict an outcome of a particular trade. No matter how good the setup is, any given trade can fail. That’s why it’s imperative for a trader to distinguish between two kinds of losses.

The first kind is a loss caused by a trader’s mistake – failure to follow all the rules of system applied, or impulsive entry without any reason at all. Such losses must be taken as a lesson. The second kind is the case where every piece of puzzle was in place, yet the trade failed – such losses must be written off as a part of trading game, as a tribute to uncertainty of the markets.

Of course, if you identify a component of your trading system that regularly causes trade failure, you can and should tweak your system in order to minimize failures. However, during the trade a stop must be taken as soon as signal of failure appears. The line of thinking “The setup was so good, it must work eventually” is a disaster waiting to happen.

Failure to perceive the market as an uncertain environment can result in another misconception:

Losses can be eliminated.

In a paradoxical way, this erroneous notion leads to more losses. A trader tweaks his system endlessly trying to get rid of losses completely. In such constant adjusting and re-adjusting, the system evolves into something totally different, losing its original logic, or even stops producing entry signals at all. As a result, a trader either abandons his system, which was not a bad one to begin with, or in a worst case, simply refuses to take losses. After all, he made his system so perfect by eliminating all the reasons for failures, it just MUST work! Meanwhile, had he stayed with original approach, maybe with some minor tweaks, it would continue producing steady results.

My trade is who I am.

This is one of those hidden subconscious misconceptions that cause us to refuse to take our stop. A trader perceives the result of his trade as a reflection of his personality, his abilities. A trade failure makes him feel as though he is a failure. Winning makes him feel "right", while losing makes him feel "wrong". Nobody likes to be a failure, to be wrong. That’s why, in order to avoid being wrong, we refuse to take our stop. You can be right and still lose on this particular trade. You can be wrong and win, too.

It’s important to differ between good and bad trade, and we will be back to this later, in the Random reinforcement part. At this point it’s important to separate your self-perception from the result of your trade. Taking a stop loss, you are stopping your loss – nothing foolish about that. The major trigger for the right approach here is a realization that by accepting the market as an uncertain environment, we already have accepted the possibility of losses. If we haven’t expected the market to work in our favor every time, there is no reason to feel foolish when it doesn’t.

A loss is just a paper loss until it’s taken.

This is a big mistake in thinking. If a loss gets out of hand, it’s very real. It paralyzes you, it clouds your judgment, and it makes you miss plenty of other opportunities. Instead of taking a pre-determined loss and moving on to another trade, you sit and watch your losing one, twitching in pain and feeling remorse. Your chance to take a small stop is long gone. You are agonizing now over big one that is going to deplete your account too much and inflict serious emotional wounds. You hardly notice many other opportunities. The market has moved on, other sectors and stocks are in play, and you still nurture your losing trade, hating it and not being able to finally drop it. At some point you will ask yourself "Why was this trade so important to me? What made me hold onto it?" And this takes us to the next common error:

Putting too much importance into single trade.

A newer trader tends to see each trade as overly important, as if it’s going to make or break him. The market is an endless stream of opportunities. The next trade is right around the corner. No single trade is so important that it would be worth abandoning all other opportunities. Perceive your trading as a process, not as separate events. With the correct approach trading becomes natural, like breathing. Each entry is inhale, each exit is exhale. Breathe in and breathe out. Don’t choke yourself trying to hold onto each given breath.

Random reinforcement.

This is an important concept to understand. The market is not always rewarding right decisions and punishing bad ones. The practical implication is that a trader runs a risk to stop applying proper techniques if he sees wrong ones being rewarded sometimes. Take a stop, observe a stock reversing and going into profit zone – and you get tempted to skip your stop next time. If you try it and it works, there is significant chance that you continue doing just that – the bad habit gets reinforced. You may win several times by breaking your rules. What happens eventually is that one trade that does not reverse destroys your account. It’s important to define what good and bad trades are. Unlike many think, a good trade is not always a winning trade; a bad trade is not always a losing trade.